Fiscal sponsor organizations are US-based nonprofit organizations that work with projects administer grant funding. Fiscal sponsorship is an arrangement specific projects working with US-based funders. The role of the sponsor is to accept and administer funds, in compliance with US tax law. Fiscal sponsors can also provide a larger umbrella that includes financial and administrative infrastructure to support grant and donation-funded projects.

You may have not have heard of fiscal sponsorship, but you are probably familiar with projects in the open source for science and scholarship space who work with fiscal sponsors. For example, ROpenSci, Project Juypter, and MatPlotLib work with NUMfocus. Dat and PREreview work with Code for Science & Society. The Carpentries work with Community Initiatives. Operating in the US and internationally, OpenCollective operates as a both a fiscal sponsor and donation platform. This platform is gaining momentum as a place to crowd-fund, showcase larger corporate donations, and operate with financial transparency.

In this post I will describe what fiscal sponsorship is and how it supports projects in our space.

Why would a project work with a fiscal sponsor?

As a project matures, it may apply for grant funding or solicit donations as a part of its startup phase or sustainability plan. In order to accept manage these funds in compliance with funder guidelines and tax law, a project needs a nonprofit designation. However, getting a nonprofit designation in the US is not a quick process. Creating and managing a nonprofit entity to house an open source project can be a time-consuming distraction. Fiscal sponsors provide fiscal oversight and administration, often with other back-office benefits, without committing the project to administering a nonprofit structure.

What models of fiscal sponsorship exist?

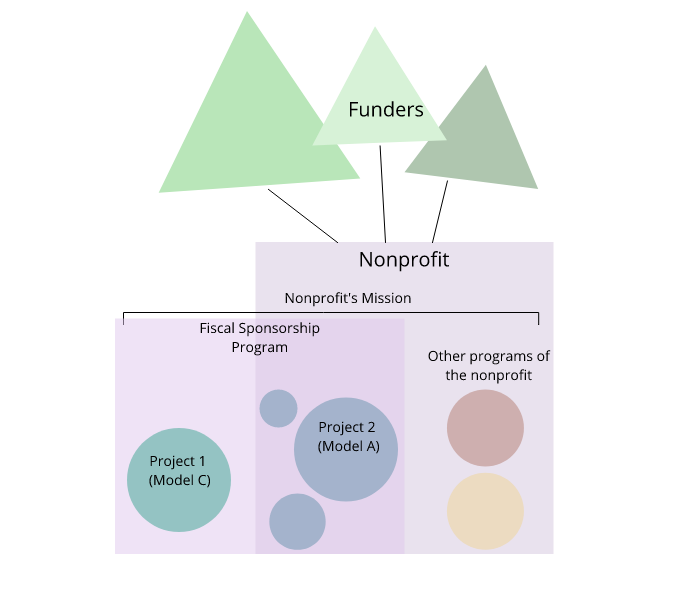

Nonprofits run fiscal sponsorship programs as a part of their broader mission. There are multiple models of fiscal sponsorship, but Model A and C are the most common in our space.

"Model A" or "comprehensive" fiscal sponsorship is a model wherein the project becomes a part of the sponsoring entity. People who work on the project become employees (or volunteers) at the sponsoring entity. For example, OpenReview (a fiscally sponsored project of Code for Science & Society) has full time employees and contractors employed by CS&S to work on OpenReview. This arrangement shifts the burden of financial administration - and in some cases HR, payroll, benefits, and other administrative activities - completely to the sponsoring entity. This reduces the time and effort spent on financial and administrative issues and may give the sponsoring entity more oversight into the day to day activities of the project.

"Model C" or the "re-grant model" of fiscal sponsorship describes an arrangement where a grant-making entity (or a donation) approves funding for a project, the sponsor holds the funds and re-grants them for the purposes of the project. The project engages volunteers, contractors, or employees and caries out their own bookkeeping and administration. In other words, the project does not become a part of the fiscal sponsor.

In both models, it's critical that the project's mission is aligned with the mission and charitable activities of the fiscal sponsor.

These are the two most common arrangements. As you may have guessed, there are many models of fiscal sponsorship. Colvin's book Fiscal Sponsorship: 6 ways to do it right is a detailed introduction to the topic.

Considerations

Requirements

To ensure oversight or a project and alignment with a sponsor's mission, there may be an application process, governance requirements, or other benchmarks a project needs to meet. Requirements differ across fiscal sponsorship organizations. At Code for Science & Society, every fiscally sponsored project needs to be approved by our board, be in line with our mission, and have an advisory committee to whom the project leader is accountable. Among other requirements, NumFOCUS requires a Code of Conduct, a group of 3-5 people to sign the fiscal sponsorship agreement, and a focus on scientific computing.

Cost

Financial administration costs money, as does providing other benefits and services under a stable nonprofit umbrella. Fiscal sponsors typically charge a percentage of total project revenue, ranging from 8% to 15% (and sometimes more for certain types of grants). These fees may be charged on top of the grant amount or subtracted from a donation - this practice varies between funders.

Intellectual Property

Particularly in Model A fiscal sponsorship arrangements, the sponsor will hold the project's copyright and intellectual property (IP). From the perspective of the project, this can be disconcerting. The goal of this is to insure that the sponsor has the right to defend copyright and IP issues, should they arise.

Flexibility

As you grow (thanks to the support of your fiscal sponsor!) you may want to start your own nonprofit or incorporate in another way. As you consider fiscal sponsorship, it's important to ask how about the process for exiting a fiscal sponsorship agreement.

Resources

Fiscal Sponsorship: A Hidden Resource for Nonprofit Entrepreneurs

Fiscal Sponsorship: A Balanced Overview

Fiscal Sponsorship: 6 Ways to Do it Right

Fiscal Sponsorship for Nonprofits

NumFOCUS on their Fiscal Sponsorship Program

Community Initiatives on Fiscal Sponsorship and their services